The OCR is increased in order to stop an over inflated economy.ġ. This is a loan that ties the interest rate AIR, to the our country’s Reserve Bank Official Cash Rate (OCR). If not, perhaps you may be able to help me to solve the problem. If there is an example that covers this, please advise point me to the link. However, I need a variation to work with a different set of rules. I have been able to follow it without any problems at all. Thank you very much for this excellent tutorial. Mortgage Calculations with Excel Formula (5 Examples).Creation of a Mortgage Calculator with Taxes and Insurance in Excel.How to Use Formula for 30 Year Fixed Mortgage in Excel (3 Methods).Mortgage Repayment Calculator with Offset Account and Extra Payments in Excel.How to Use Formula for Car Loan Amortization in Excel (with Quick Steps).Excel Interest Only Amortization Schedule with Balloon Payment Calculator.

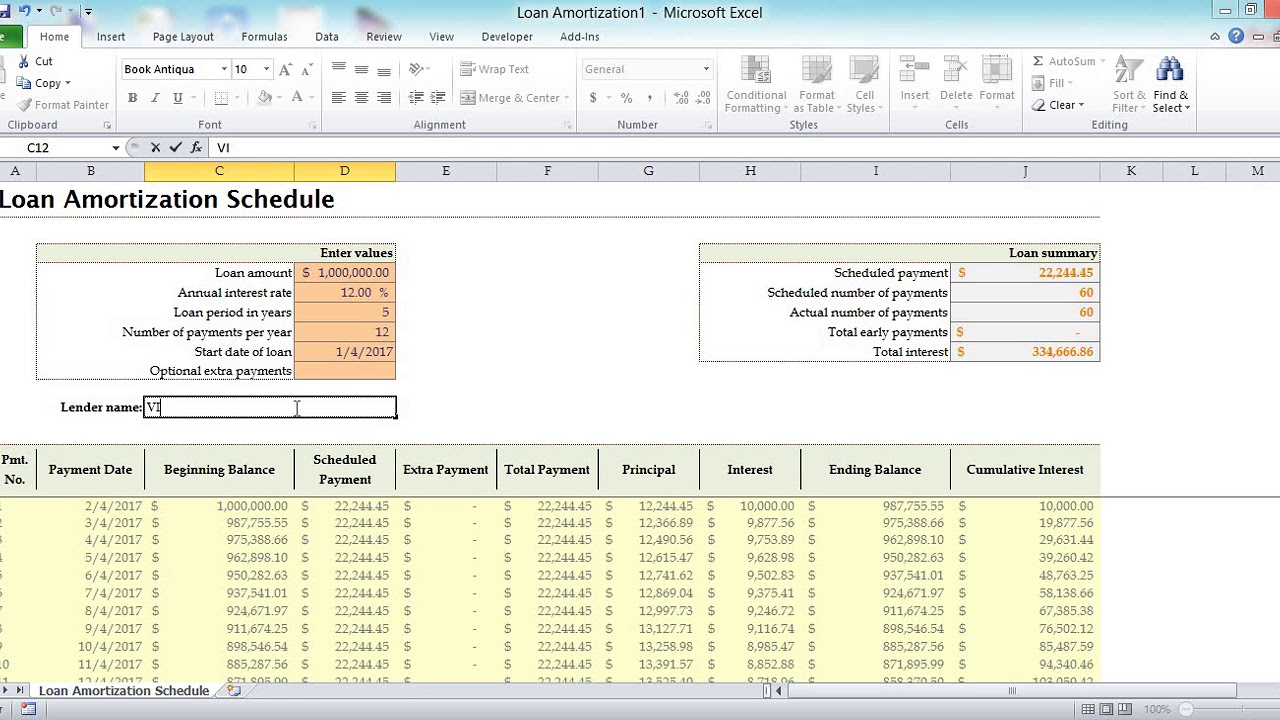

Step-1: Calculate the Payment Amount, PMT Thus, in the Period column, we have taken a serial number from 1 to 24. Total Number of Payments Against the Loan = (The number of Years x Loan Payment Frequency per Year) = 2 x 12 = 24. I will show you to prepare a loan amortization schedule based on the following data. How to Prepare a Loan Amortization Schedule with Variable Interest Rate in Excel Steps to Prepare a Loan Amortization Schedule with Variable Interest Rate in Excel In the table, the total number of periods to pay back the loan, the remaining balance to pay, how much money you are paying for the interest, and the original amount all are stated. Loan Amortization Schedule with Variable Interest Rate.xlsxĪ Loan Amortization Schedule is a table of period payments against the loan.

0 kommentar(er)

0 kommentar(er)